Sometimes, it’s hard to know exactly how much you should invest in a bet. Since we want you to become a successful punter, we couldn’t let this one slide.

After discussing what an odd is and what a value bet is, we will show you some simple tips on how to calculate the amount you should spend in each bet.

We call this Bankroll Management and it is as important as knowing how to find a value bet. By applying this to your bets, you can secure more winnings in the long run.

But, how? We will explain everything in this article.

How can you manage your bankroll?

Basically, your bankroll is the amount of money you keep to invest in your bets. It’s like a safe box or a piggy bank where you only put the money you want to use for your sports betting.

This way you won’t spend too much and you will organize your savings more precisely.

Below is an example of a classical bankroll management error you should avoid:

I have N100,000 in my bankroll! I’m going to bet N10,000 on Chelsea winning as visitors (odd: 2.10) and N50 000 on Manchester United. They are playing as hosts against a weaker team (odd: 1.25) so they are totally going to win!

The bet on Chelsea ended up being a success, but Manchester draws with a team that is on the 14º position on the Premier League – which is not that unusual.

So, even though you won one bet, this bankroll went from N100,000 to N71,000.

A loss like this means a decrease of 29% from your initial bankroll because of a single bet.

This is just an example to show you how important it is to make your bankroll profitable!

But how can you do it more efficiently?

Evaluate the risks and don’t put too many eggs in one basket. That way you don’t have to say goodbye to your money right after you place a bet.

Once again, it’s crucial to remember that this is a long-term process. If you want to win big in sports betting, you need to focus on learning more about these details.

Soon, they will be a part of your betting experience. But don’t worry! We are here to help you along the way!

The best part is that there are some easy strategies that you can use to improve your bankroll management.

Before we get started on that, it surely helps if you bet on a good sportsbook with good odds.

Betting Sites with the Best Odds

Three Methods for Bankroll Management

1. Fixed Value Method

- Allows you to know how much you will spend

- Since you know the right amount, there won’t be unpleasing surprises

- Super easy to use

- Too strict and it doesn’t contemplate variations in your bankroll

As the name suggests, this method is all about establishing a fixed amount from your bankroll for your bets.

The Fixed Value is limited and strict, but it is a great way for you to get familiar with a well-structured bankroll.

💡 WITH THIS METHOD, YOU WILL ALWAYS BET THE SAME AMOUNT IN ALL YOUR BETS.

Imagine your bankroll has N50,000, and in this scenario, you would establish your limit per bet as N3,000. In every bet, you will only use N3,000, which represents 6% of your bankroll.

If you choose a bet that has an odd of 2.00, you will win N6,000. This way, your bankroll would have N56,000 by the end of this bet.

So the rule is: even if you win more, you will keep betting N3,000. And that is the trick!

To protect you from big losses, you keep betting the same amount of money. The only downside is that this method doesn’t consider the altercations in your bankroll.

There could be times when you’ll want to place 5 bets in a row. If all of them have odds of 2.00 and you bet N3,000 in each of them, your bankroll would have N70,000 if you won all of them. By this, the N3,000 now represent 4,3% of your bankroll.

What would happen if all of those bets were unsuccessful?

Just remember that if the amount on your bankroll decreases, the amount you bet should follow those alterations. It wouldn’t be smart to keep using N3,000 if that amount represents 10% of your bankroll. Otherwise, it won’t work that well.

Even professional punters admit they only use 2% or 5% of their bankroll.

If you feel the amount has come to high percentages, maybe it’s better to try another method.

2. Percentual Value Method

- Allows you to have more control over your finances

- It is a dynamic method

- Acknowledges the variations in your bankroll

- May be hard to follow in bankrolls with a high amount of money

- You need to change the percentage to control your losses

- Requires more experience

The enormous advantage of this option is that it presents a safer and more flexible method for you to run your bankroll.

According to this system, you will always bet a fixed percentage value from your bankroll pre-established before your bets. Usually, most people use between 5% to 10% of their bankrolls.

This is a great way for you to achieve a balance between what you win and what you lose.

We will show you an example.

If you use 10% of your bankroll, you will always bet 10% of your money in each bet.

| Bankroll | Bet | Result |

|---|---|---|

| N50,000 | N5,000 | ✅ |

| N55,000 | N5,500 | ✅ |

| N60,500 | N6,050 | ❌ |

| N54,450 | N5,445 | ❌ |

| N49,005 | N4,900 | ✅ |

| N53,905 | N5,390 | ✅ |

| N59,295 | N5,929 | ✅ |

Just in 6 bets, they could win N9,295 by spending 10% of their money each time. This example applies to odds of 2.00.

This doesn’t happen all the time! But it could happen.

By using this method, you could even take a risk and change the percentage if you feel that is a good call. Sometimes, you can increase the percentage you bet when you find a value bet, per example.

Now that we dug deep into this method, it’s easy to see how it is more flexible than the fixed method. It’s all part of a more dynamic strategy where you don’t have to bet the exact same amount of money, but you can adapt your next move according to the percentage used.

If you find a value bet and your bankroll has N10,000, you should use 10% of that. For this example, that would be N1,000.

If you win, that’s amazing! But if you lose, maybe the right move is to drop that percentage a notch. Don’t look at it as a restriction. It’s more of a safety measure.

If you only use 5% of your bankroll in your next bet, you will decrease the risk of it getting worse. And that is where the big advantage of this method resides.

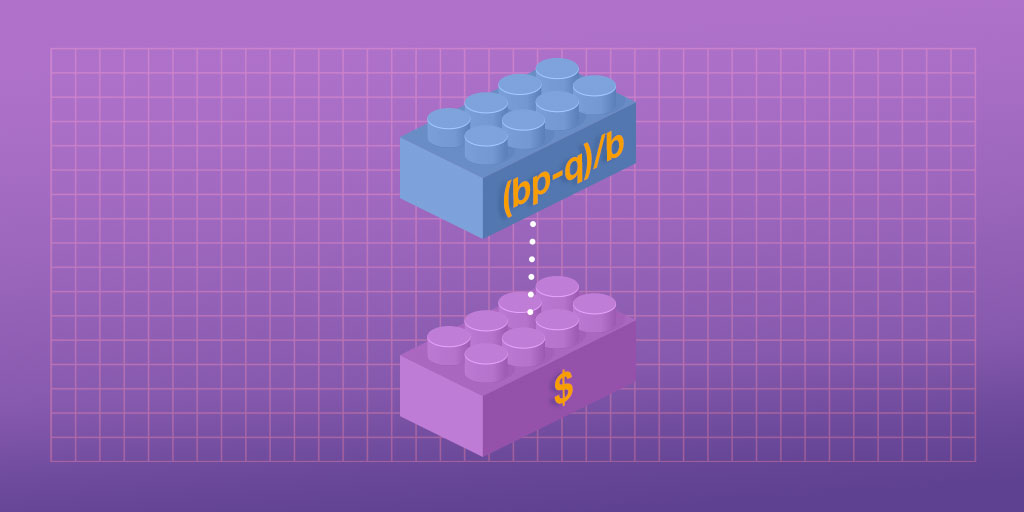

3. Kelly Criterion Method

- Based on calculated probabilities and the odds shown by the bookie

- The most dynamic method

- Allows you to easily identify value bets

- It could suggest high percentage bets for your bankroll

- It’s based on a mathematical formula

This is one of the more complex and effective methods in bankroll management. To prove this, the Kelly Criterion is used for sports betting and even financial investments.

It takes into account the odds of an event to determine when is the right time to bet.

There are some variations to this method. To help you out, we are going to explain the easiest. The formula is:

(B x P – Q) / B

- B = Deciamal odd

- P = Real probability

- Q = 1 – P

Let’s suppose that you will bet in a World Cup match: Italy vs. Germany.

These are the odds for this match:

| Germany | Draw | Italy | |

|---|---|---|---|

| 1,71 | 3,25 | 3,65 | |

| 58,5% | 30,8% | 27,4% |

By converting these odds into percentages, it is clear that this bookie believes that Germany will win.

The deal breaker is that you have seen all the games from Germany and from Italy lately and you have been paying attention to each of their strategies. After taking a good look, you know the real probability of Germany winning is closer to 65%.

According to Kelly Criterion:

- B = 1,71 – 1 = 0,71

- P = 0,65

- Q = 1 – 0,65 = 0,35

(0,71 x 0,65 – 0,35) / 0,71 = 15,7%

For this bet, this formula tells us to take a higher risk and bet 15,7% of our bankroll.

For some, this could be a little high. But most of the times it could even get to 20% or 30%. You will have to be the judge of how much you are willing to put on the line.

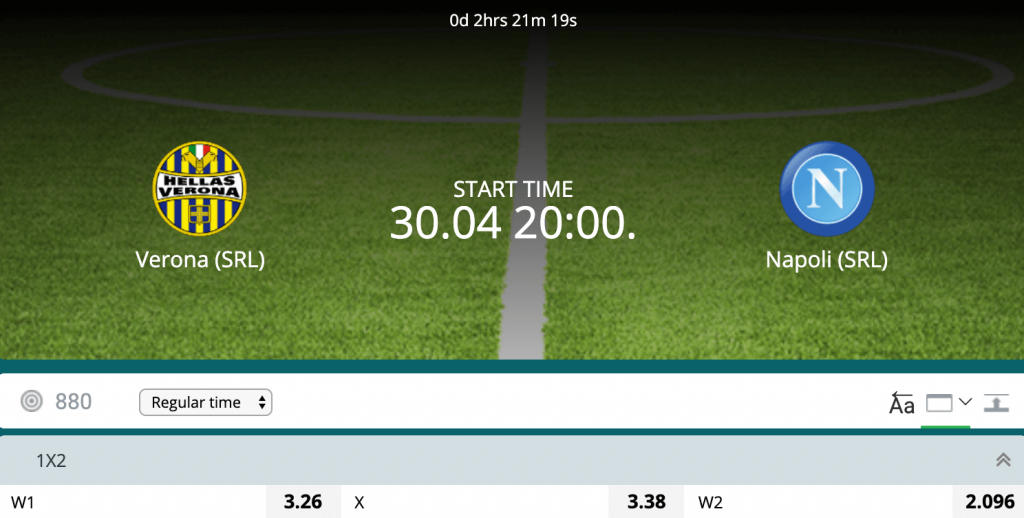

Practical Sports Betting example

To help you out, let’s see this example for this Italy Serie A match:

By converting the odds of this match, we get these percentages:

- Verona win @ 30,67%

- Draw @ 29,59%

- Napoli win @ 47,70%

In this scenario, you have been following all the matches played by Verona and you feel that they are improving their game and strategy.

Maybe their real winning probability is higher than what the bookie tells us. So you think they have a 40% chance of winning.

- P = 0,40

- B = 3,26 – 1 = 2,26

- Q = 1 – 0,4 = 0,60

This way: (2,26 x 0,4 – 0,6 ) / 2,26 = 13,45%

For this case, the Kelly Criterion suggests you bet 13,45% of your bankroll. If you have N5,000 in your bankroll, you should bet N672 on Verona.

But wait! There is still an important issue that deserves your attention!

Do you remember what we said about the bookies taking a part of the profit for themselves? By adding all the probabilities, the total is 107,96%!

This means this bookmaker has a profit of 7,96%! By the look of it, this could be a value bet.

Conclusion

Now that you know all the basics about sports betting, like how do odds work and how to find value bets, it’s time to increase your knowledge. It can be hard to understand how much of your earnings you should bet.

Since we don’t want you to spend more than what is necessary, we suggest you keep a balance between what’s fair and what’s right to spend.

If you find a value bet, you should use the Kelly Criterion to know exactly how much of your bankroll you could invest in this bet.

Experienced punters use more than one method and, when the time comes, you will navigate through all of these strategies. You don’t have to be faithful to only one.

The right method for you is the one where you feel comfortable and safe that your bets will give you big winnings. You have time to improve your tactics and up your game. The more you bet, the better you will be.

200% ON YOUR FIRST DEPOSIT

200% ON YOUR FIRST DEPOSIT